Welcome to our comprehensive guide on how to trade with the trend in forex trading. In this article, we will explore effective strategies and techniques that can help you capitalize on market trends and enhance your trading performance. Trading with the trend is a popular approach among successful traders, as it enables them to align their positions with the prevailing market direction. By understanding how to identify and trade with the trend, you can potentially increase your profitability and make more informed trading decisions. So, let’s dive into the world of trend trading and discover valuable insights that can elevate your forex trading game.

How to Trade with the Trend in Forex Trading: A Winning Strategy

Trading with the trend can be a profitable strategy when executed correctly. Here are some key steps to follow when trading with the trend in forex trading:

1. Identify the Primary Trend

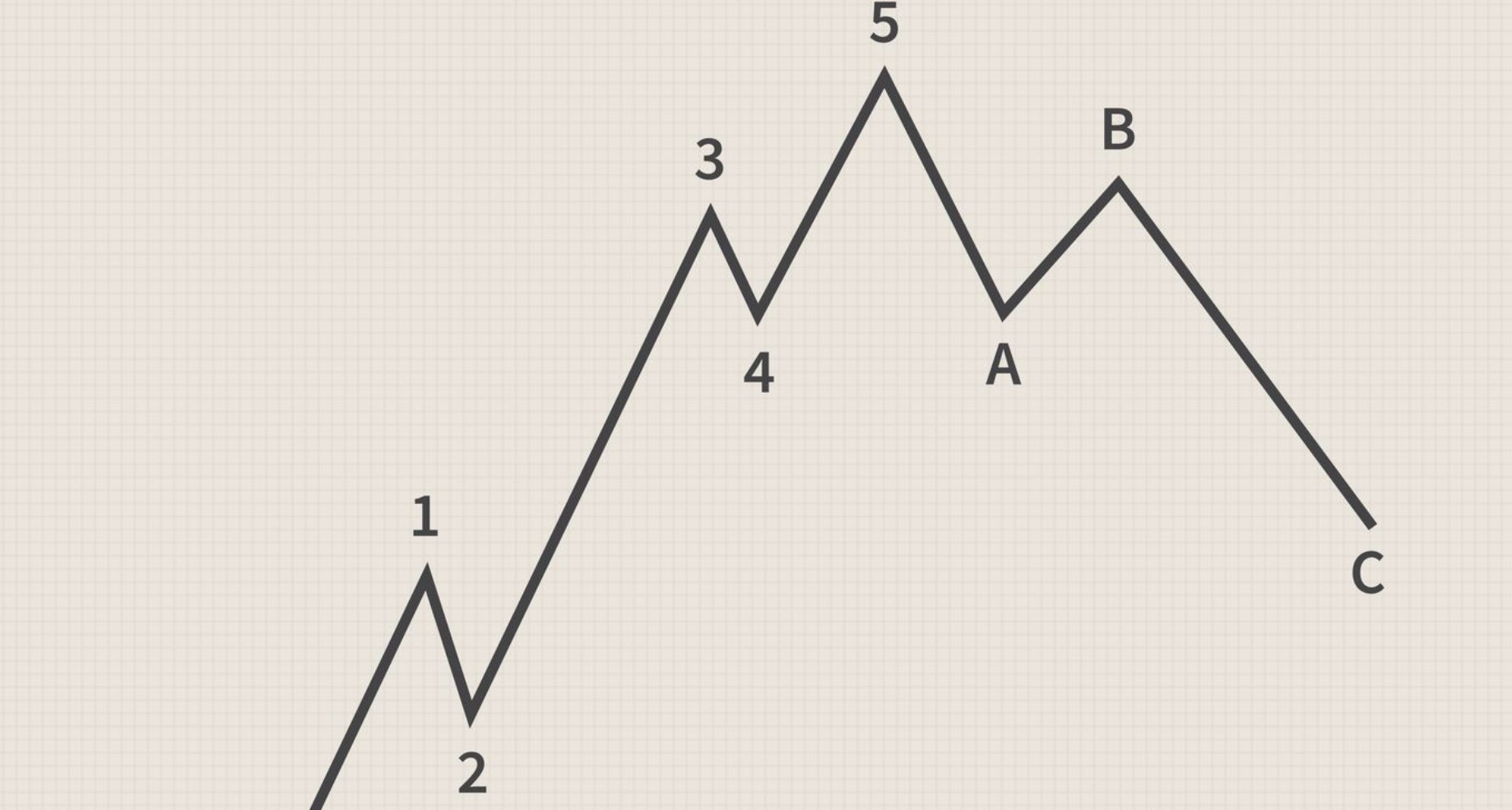

To trade with the trend, it’s crucial to first identify the primary trend. This can be done by analyzing price charts and identifying the general direction of the market. A primary trend can be classified as either an uptrend (higher highs and higher lows) or a downtrend (lower highs and lower lows).

2. Use Technical Indicators

When it comes to trading with the trend in forex trading, technical indicators play a crucial role in identifying and confirming trends. These indicators provide valuable insights into market momentum and help traders make informed decisions. Let’s take a closer look at some popular technical indicators and their significance in trend trading:

| Indicator | Description | Significance |

| Moving Averages | Moving averages smooth out price data over a specified period and help identify the trend direction. | They provide a visual representation of the trend and can be used to generate trading signals when different moving averages cross over. |

| Trendlines | Trendlines are drawn on a price chart to connect swing highs or lows. They help visualize the trend and potential areas of support or resistance. | Breakouts or bounces off trendlines can indicate trend continuations or reversals. |

| Average Directional Index (ADX) | The ADX measures the strength of a trend. It ranges from 0 to 100, with higher values indicating a stronger trend. | Traders can use the ADX to determine whether a trend is strong enough to warrant trading or if it’s better to wait for a more favorable setup. |

| Ichimoku Cloud | The Ichimoku Cloud is a comprehensive indicator that displays support and resistance levels, trend direction, and momentum. | Traders often use the cloud’s position and color changes to confirm trend direction and identify potential entry or exit points. |

These technical indicators, along with many others available, provide traders with valuable insights into market trends. However, it’s important to note that no single indicator can guarantee success. It’s recommended to use a combination of indicators and apply them in conjunction with other analysis techniques to increase the accuracy of trading signals. Remember to adapt the indicators based on your trading style and the specific currency pairs you are trading.

In summary, technical indicators serve as powerful tools for identifying and confirming trends in forex trading. By incorporating moving averages, trendlines, the ADX, and the Ichimoku Cloud into your analysis, you can gain a deeper understanding of market dynamics and make more informed trading decisions. Combine these indicators with proper risk management and a comprehensive trading strategy to enhance your chances of success in trend trading.

3. Enter Trades in the Direction of the Trend

Once you have identified the primary trend and confirmed its strength, focus on entering trades that align with the direction of the trend. For example, in an uptrend, look for opportunities to buy or go long, while in a downtrend, consider selling or going short.

4. Implement Proper Risk Management

Regardless of the strategy employed, risk management is a critical aspect of successful trading. Set appropriate stop-loss orders to protect your capital in case the market moves against your position. Additionally, consider implementing trailing stops to secure profits as the market continues to move in your favor.

5. Use Price Patterns and Breakouts

In addition to analyzing trends, incorporating price patterns and breakouts into your forex trading strategy can provide valuable insights and enhance your trading decisions. Price patterns are formations that occur on price charts and can signal potential reversals or continuations in the trend. Breakouts, on the other hand, occur when the price moves beyond a defined support or resistance level. Let’s explore some common price patterns and how they can be used in trend trading:

- Flags: Flags are short-term consolidation patterns that occur after a strong price move. They resemble a rectangle or a parallelogram and indicate a temporary pause in the trend. Traders often look for breakouts from flag patterns as a signal to enter a trade in the direction of the prevailing trend.

- Triangles: Triangles are chart patterns characterized by converging trendlines that form a triangle shape. They can be symmetrical, ascending, or descending. Triangles indicate a period of indecision in the market but often precede significant price movements. Breakouts from triangle patterns can be used to confirm the trend continuation or reversal.

- Head and Shoulders: The head and shoulders pattern is a reversal pattern that signifies a potential trend change. It consists of three peaks, with the middle peak (the head) being higher than the other two (the shoulders). A breakout below the neckline of the pattern is considered a bearish signal, while a breakout above the neckline is seen as a bullish signal.

By recognizing and analyzing these price patterns, traders can anticipate potential trend reversals or continuations and time their trades more effectively. However, it’s essential to confirm these patterns with other technical indicators or price action analysis to reduce false signals. Combining price patterns with trendlines or indicators like moving averages can provide additional confirmation and increase the reliability of trading signals.

It’s important to note that no pattern or breakout strategy guarantees success in trading. Proper risk management, including setting stop-loss orders and managing position sizes, is crucial to protect against potential losses. Additionally, regular monitoring of price patterns and breakouts is necessary, as market conditions can change quickly.

In conclusion, incorporating price patterns and breakouts into your forex trading strategy can be a valuable tool in identifying potential trend reversals or continuations. By learning to recognize and analyze patterns like flags, triangles, and head and shoulders, traders can gain an edge in their decision-making process. Remember to combine these patterns with other technical analysis tools and employ proper risk management techniques for successful trend trading.

6. Continuously Monitor and Adjust

Continuously monitoring the market and adjusting your trading strategy is essential for staying ahead in forex trading. Markets are dynamic and can change rapidly, so it’s crucial to keep a close eye on your trades and the overall market conditions. Regularly review your positions and assess their performance. Look for any signs of potential reversals or shifts in the trend that may require adjustments to your trading strategy.

Stay updated on relevant news, economic indicators, and geopolitical events that can impact the market. These factors can influence the trend and create new trading opportunities or risks. By staying informed, you can make more informed decisions and adapt your strategy accordingly.

Remember that no trading strategy is foolproof, and the market can be unpredictable. Be prepared to make adjustments as necessary based on market conditions and the performance of your trades. Continuously monitoring and adjusting your approach will help you stay proactive and maximize your chances of success in forex trading.

FAQs

Here are some frequently asked questions about trading with the trend in forex trading:

1. How do I determine the trend in forex trading?

To determine the trend in forex trading, analyze price charts and look for higher highs and higher lows in an uptrend or lower highs and lower lows in a downtrend. Additionally, use technical indicators like moving averages or the ADX to confirm the trend’s strength.

2. What are some effective technical indicators for trend identification?

Popular technical indicators for trend identification include moving averages, trendlines, the ADX, and the Ichimoku Cloud. These indicators can help you assess the market’s momentum and identify potential entry and exit points.

3. Should I always trade with the trend?

While trading with the trend can be advantageous, it is essential to consider other factors such as market conditions and risk appetite. There may be instances where counter-trend trading strategies can also yield profitable opportunities. It is crucial to have a flexible approach and adapt to varying market conditions.

4. How can I manage risk when trading with the trend?

Managing risk is crucial in any trading strategy. Set appropriate stop-loss orders to limit potential losses and consider implementing trailing stops to protect profits as the market moves in your favor. Additionally, avoid overleveraging and diversify your trades to spread risk.

5. Can price patterns help with trend trading?

Yes, price patterns can provide valuable insights when trading with the trend. Patterns such as flags, triangles, or head and shoulders can indicate potential market reversals or continuations, allowing you to make more informed trading decisions.

6. How often should I monitor my trades when trading with the trend?

Monitoring your trades and the overall market conditions is vital for successful trading. Regularly review your positions and stay updated on relevant news and events that may impact the trend. Adjust your trading strategy accordingly to maximize your chances of success.

Trading with the trend in forex trading can offer significant advantages and improve your trading results. By identifying the primary trend, utilizing technical indicators, entering trades in the direction of the trend, implementing proper risk management, and using price patterns, you can increase your profitability and make more informed trading decisions. Remember to continuously monitor the market and adapt your strategy to changing conditions. Embrace the trend and let it guide you towards trading success.